Weekly Market Update – April 24th 2020

Happy Friday everyone! On today’s blog we want to update you on the this weeks happenings in the world.

What were the key developments this week?

Canadian and U.S. equity markets continued to fluctuate as investors weighed the possibilities of slowly easing lockdown restrictions and a quick economic recovery against the fallout of plummeting oil prices.

-On April 20, U.S oil prices fell below zero for the first time in history, ending the day at -$37.63. With so much of the economy paused, the absence of demand has left a lack of storage facilities for soon-to-be-delivered oil. As expected, last week’s OPEC production cut was not enough to rectify this.

-Canada’s annual inflation rate fell to a near five-year low in March as gasoline prices plunged.

The U.S. announced weekly jobless claims of 4.427 million, bringing total job losses to over 26 million in the last five weeks, wiping out all gains since the Great Recession.

-The U.S. House of Representatives approved a $484 billion coronavirus relief bill to fund small businesses and hospitals; this brought the country’s total crisis response funds to almost $3 trillion.

-The number of confirmed COVID-19 cases worldwide surpassed 2.6 million. Europe continued to slowly loosen restrictions in certain regions, as did some southern U.S. states.

Should any of this change my views on my investments?

The market’s recent turbulence has been difficult emotionally for many investors, and we should be proud that we have followed our long-term plan. Going forward, we will continue to see numbers like those above; some may be positive for the economy and others negative, but it is important to see them as data that are constantly changing, rather than as indicators to overhaul your portfolio.

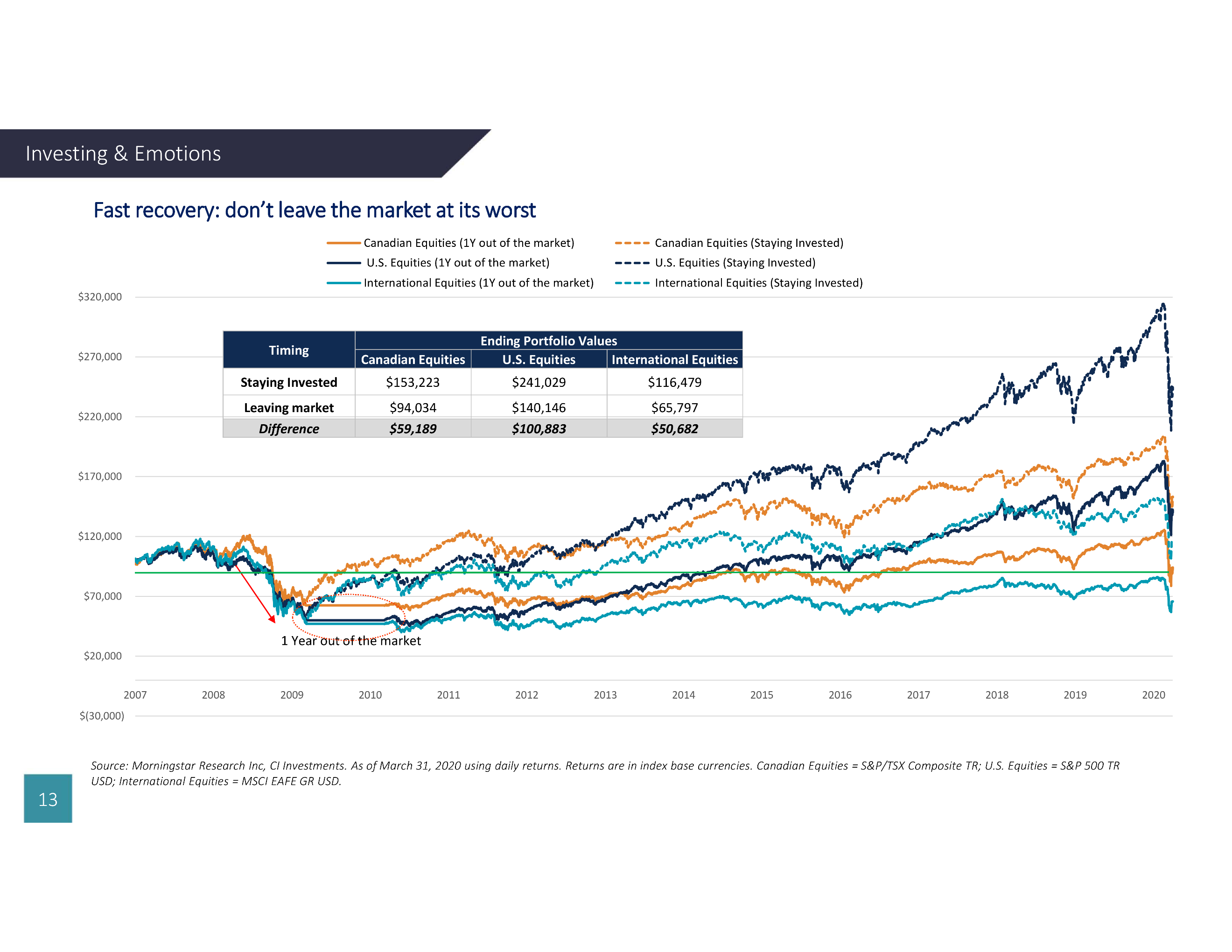

To emphasize the benefits of staying invested in both good times and bad, I thought I would share the chart below. Regardless of what the market does in the days, weeks, months and years ahead, history has shown that staying the course has reaped benefits over the long run. My advice is to continue to do so as developments such as this week’s drop in oil prices play out.